Kelley Blue Book said last year families making more than $150,000 bought up 43% of all the new cars that were sold.

DALLAS — We need to talk about the cost of vehicles. Because they have been getting even more expensive.

By one analysis, new vehicles sold in December went for an average of $50,326.

Considering that, expert analysis concludes that auto sales (and non-sales) can be attributed to our K-shaped economy, where the haves are just doing better and better and the have-nots are not.

Kelley Blue Book said last year families making more than $150,000 bought up 43% of all the new cars that were sold. That is a much higher share than they accounted for (33%) in 2019. And families making less than $75,000 only bought about 25% of the new cars that were sold, down from about 33% before.

Just out of curiosity, how is your car payment looking?

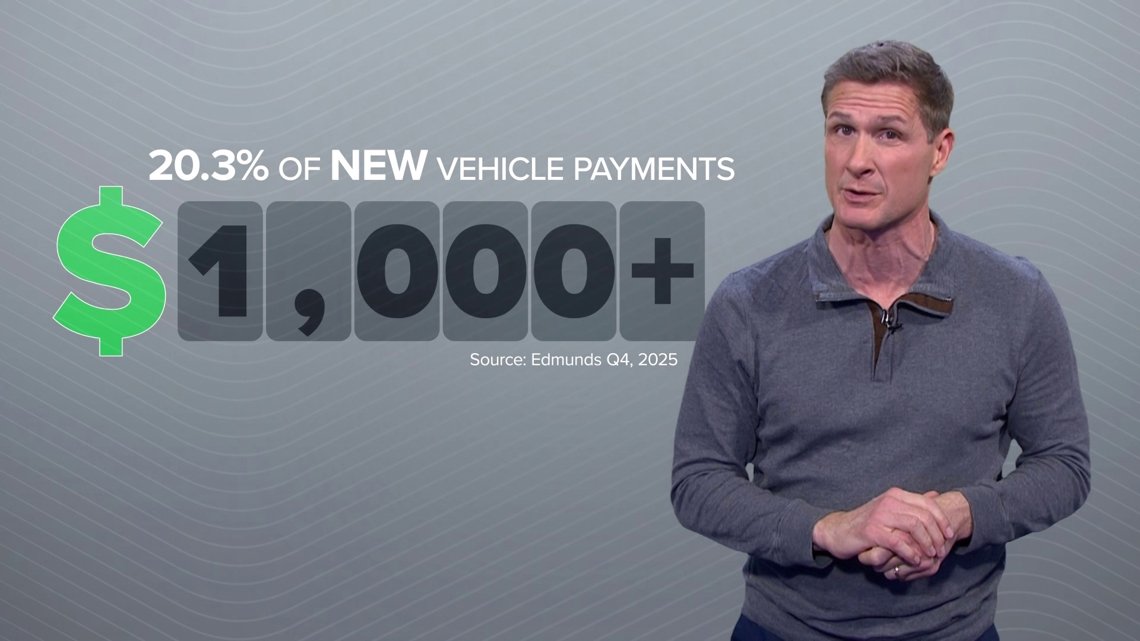

In the last quarter, fresh data showed that Americans set new records for the average amount they financed ($43,759) and for whopper car notes. 20.3% of new car buyers drove off with a monthly car payment of $1,000 or more. Another record: 6.3% of buyers took on $1,000-plus monthly payments for used cars.

And you know how everything is bigger in Texas? Well, that doesn’t just apply to the good things. In the latest analysis last year, 12.8% of new car loans in Texas resulted in monthly payments of $1,000 and up. That was a bigger percentage than anywhere else in the country.

Also, as Bankrate noted in December, auto loan delinquencies were also Texas-sized. We had the largest percentage of people behind on their car payments (7.92%). That means that about 1 out of 12 car payments here were running late.

Considering record new car prices, some buyers are just opting to stretch out the payments. The most recent data says more than 1 out of 5 new car loans lasted 7 years. Of course, that can lower the monthly payment. But in the end, the vehicle costs more because of all that interest. Even used cars had an average loan term of almost six years.

Many people are just coddling their vehicles these days, so they don’t have to buy a new one in this current price environment. The average age of cars on the road right now is at an all-time high of 12.8 years old.

Think about that, the typical driver is holding on to a car that first hit the road way back in 2013, when according to Wikipedia, the biggest hit on the radio was ironically Thrift Shop by Macklemore and Ryan Lewis.

But what if you feel ‘forced’ into buying a new car?

That may sound like an odd question, but we have another record to talk about: The percentage of vehicles that insurers are deciding to total just hit a new all-time high. Insurance companies are declaring 22.8% of wrecked autos a total loss.

In a recent earnings call, Dallas-based Copart reported that an increasing portion of those totaled cars are, in fact, able to be repaired and become drivable again.

Copart sells cars on behalf of the insurance industry, and they note that they are getting all-time high average selling prices for them. So, insurers may be able to offset some of their costs for totaling vehicles.

But what do they pay you? You get actual cash value for your totaled car. Which may not be nearly enough for you to afford to replace it, especially considering how much car prices and finance rates have risen.

So just know that if they decide to total your car, you can contest that with your own appraisal. And a new law now in effect in Texas is designed to speed up the process and give a neutral umpire the final decision if your appraiser disagrees with the insurance company’s.